Table of Contents

Disclaimer: This content is provided for educational and entertainment purposes only and does not constitute professional advice. We do not guarantee the accuracy or completeness of any information presented. We are not liable for any actions taken based on this content. For specific issues or decisions, we recommend seeking professional advice. This content is not promoted on social media.

TransferWise Review

If you need to send money to India then TransferWise can be a good option. I have personally used TransferWise Australia and very happy with the service. The best part about their website is probably the user interface. The site is really easy to use, and overall it takes hardly less than five mins or so to do the overall transfer. It saves your receivers details for future use which means next time you login, you can do a quick transfer without having to enter all the bank details of the receiver.

It is a pain and too much hassle to enter sender details each time you wish to transfer so I am glad they save it once you enter it the first time.

On your home page after you login (or dashboard), they show you most recent transactions made in the recent past. If you need to have a quick look of all the money you sent in last few months you can check here.

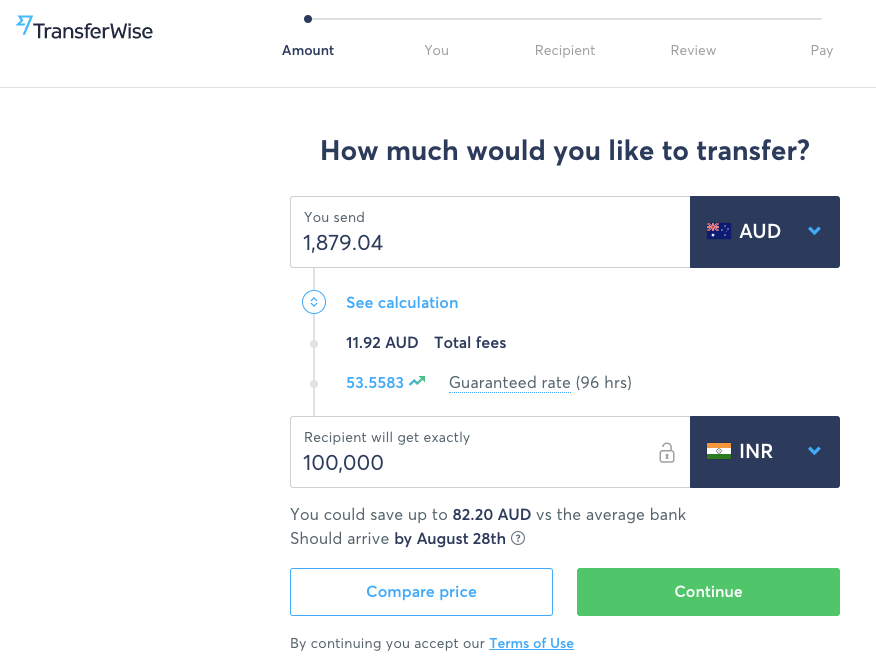

When you click on SEND MONEY button, it shows a very simple and easy screen (as shown below) where you can enter amount either in Indian Rupees (INR) or in Australia dollars (AUD).

Indians in Australia often have to send money to India for various reasons such as family maintenance, send money to contractors in India, property maintenance and so on. Having a quick and easy service can be a big help especially for those who transfer money frequently. TransferWise offers its customers a fast, easy, and cheap way to transfer money overseas. With a wide range of currencies available, and new ones added often, TransferWise is used across the globe. It is ideal for international students, travellers, and those living overseas. Read on to find out all you need to know about TransferWise.

CHECKOUT THEIR WEBSITE TO REGISTER TODAY>>

TransferWise offers a convenient way to send money overseas quickly and cheaply. The fees are transparent and the exchange rates are honest. The only potential downsides are that your recipient must have a bank account, and that for larger transfers it may not be the cheapest option.

TransferWise exchange rates

With TransferWise, the currency is exchanged at the mid-market rate. This means that the exchange rate you get is the same as the one you would find on Google, and it accurately represents what the money is actually worth.

What’s a guaranteed rate?

As per their website, a guaranteed rate is exactly what you’d expect: an exchange rate that’s guaranteed for a specified period of time. TransferWise do offer guaranteed rates for all of their transfers.

As you finish setting up your transfer, we’ll guarantee your rate for a certain period of time. It’s important that you send your money to us right away so we receive your money on time. As long as we receive your money within that period, you’ll get that rate locked.

If your money doesn’t reach us in time, we’ll still convert and send it as soon as possible. But we’ll use the mid-market rate instead.

TransferWise fees

The TransferWise fees to send money from Australia to India is around $6.6 if you send A$1000 (or around 50,000 INR) or $12.6 to send 1 lac Rupees (around A$2,000) at the time of writing this article. This is of course just to give you an idea and to get latest fees you need to check their official site and enter the amount.

TransferWise fees are based on how you are transferring the money, and how much money you are transferring. The methods of transferring money vary between different countries; however, you can view each method and the fee before selecting one.

The fee is calculated as a percentage of the payment amount, with percentages varying between different currencies. If you are transferring a very small amount of money, there is a cheap minimum fee.

Whilst this may seem confusing, it is very easy to simply enter the payment details into the Transferwise app and see the cost for yourself. The most important thing to take away is that Transferwise fees are generally low.

What kind of transfer can you make with TransferWise?

At present, TransferWise only allows you to transfer money to a bank account, with no option to send funds to a cash pick-up location or mobile wallet.

You can pay for your transfer using bank transfer, debit card, credit card, apple pay, or android pay. Bank transfers generally incur the lowest fees.

The minimum transfer amount is AUD $1, and the maximum is $1.8 million.

How to use TransferWise

First, make your way to the TransferWise website, or download the app. You will then need to create an account. Next, enter how much money you want to send, and what currency you want to transfer it to. You will then be shown the exchange rate, fees, and an estimate of how long the transfer will take. TransferWise transactions usually take 1-2 business days.

Next, enter your personal details, the recipient’s details, and upload your ID. Finally, pay for your transfer, and wait for your money to be received.

CHECKOUT THEIR WEBSITE TO REGISTER TODAY>>

How does verification work at TransferWise?

Below is info. from their official website on how to verify your bank account with TransferWise:

“When you open a bank account, you usually need to take some ID into the bank branch. TransferWise is no different. We’re a financial institution, so we need to know who’s using our service. It helps us combat money laundering, and keep everyone’s money safe.

So depending on where you’re sending money from, and how much you send, we’ll ask for you to verify your identity. This helps us keep your money safe.

If you have a TransferWise for Business account, we also need to verify information about your business. You can find out more about business verification here.”

note: Once your account is verified which is necessary of course, it is easy road from there. As mentioned earlier, you simply login and start your transfer with easy to use website interface.

How does verification work?

As per their official site

“We usually verify your identity with some photo ID, proof of address, and/or a picture of you holding your ID.

When and how we verify you depends on a few things:

- The amount you send

- When you send larger amounts, like 80,000 GBP or more, we might need to see additional documents that show how you got the money.

- When you send smaller amounts, we’ll usually verify your identity.

- The currency you send

- Some countries require some proof of identities to send any amount.

- Some currencies require further identification. For example, sending US dollars requires an online banking log in.

- How many transfers you’ve made

- While we might only verify your identity at first, we might need to verify your address later on.

Sometimes, we need to ask for additional documents once a transfer has started. Rest assured our team will work tirelessly to verify these documents as soon as possible to get your money moving again.

Other times, we can automatically verify you when you make a bank transfer. If your transfer comes from your own bank account, and your name there matches with the name on your TransferWise account, we consider this a first form of identity confirmation. You may not need to do ID or address verification in this situation.

We can only do this for some currencies, and if you send below 15,000 EUR. We can’t do this for business accounts, either. ”

What types of documents does TransferWise accept?

As per their official site “Everything on the document you share should match the information on your TransferWise account. Make sure the photo isn’t blurry or covered, so we can see all the info. If there’s information on the back of your document, we’ll need to see that, too. Make sure the document isn’t in Arabic, Aramaic, Azerbaijani, Hebrew or Urdu text — we don’t have the resources to support these.

A valid ID document can be:

- Passport (photo page only)

- National ID card (we only accept the most recent version of the Nigerian national ID card)

- Photo driver’s licence (except New Zealand residents sending NZD)

A valid proof of address document can be:

- Utility bills: gas, electric, or landline phone (no mobile phone bills)

- A bank or credit card statement (photo/scan of a physical letter or PDF of statement)

- A council tax bill, or a HMRC notification

- Vehicle registration or tax

- Photo driving licence showing your address and expiry date

- Any other government or financial institution-issued document

How does selfie verification work?

As per their official site

“We sometimes ask customers for selfie verification. That means uploading a picture of yourself (a selfie) while holding your ID. Find out more about selfie verification.”

How long does verification take?

As per their official site

“If we ask to verify you while setting up a transfer, we’ll start reviewing your documents once we have received the money for the transfer. From there we’ll work to get it done within 2–3 working days. When successfully verified, we’ll automatically resume your transfer, and let you know by email.”

CHECKOUT THEIR WEBSITE TO REGISTER TODAY>>

Latest posts by Indians In Australia (see all)

- Latest Updates for Indians in Australia - November 28, 2024

- Latest Migration Status of Indian Students in Australia: Trends, Preferences, and the Surge in Tourism - February 7, 2024

- Celebrate Indian Culture in Australia with These Events in August 2023 - August 6, 2023